Smartphone Users Average 30 Apps a Month, 9 Apps a Day

It can be difficult for companies making the decision about whether to invest in application development when app usage is often already dominated by top players (social media, video). New research from App Annie, however, indicates a greater willingness for smartphone users to install apps (and often).

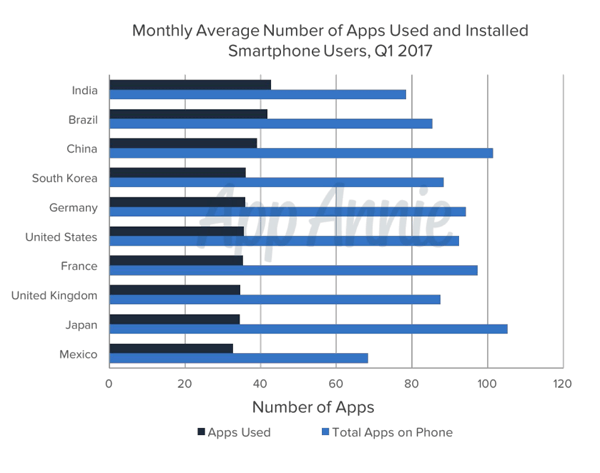

According to App Annie's Spotlight on Consumer App Usage, in all 10 countries analyzed (see image), the users on average used over 30 apps per month and over nine apps per day. Plus, in all countries analyzed, more than 65 percent of users installed at least one app in May 2017.

What's more, there is plenty of opportunity for those app makers/marketers to engage users in-app as App Annie projects time spent in mobile apps to exceed 3.5 trillion hours in 2021. Not all countries are created equal when it comes to mobile app usage and comfort level, however.

App Annie estimates that compared to U.S. consumers, Chinese consumers, for instance, are nearly three times as likely to buy food and groceries via their devices, two times more likely to transfer money using apps and four times more likely to spend majority of disposable income on mobile.

Website Magazine asked App Annie Senior Vice President of Research and Professional Services Danielle Levitas what U.S. app makers/marketers can learn from some of the trends emerging in China. Here's what she had to say:

"Great experiences are all about reducing friction for your customer," said Levitas. "China is leading the charge on mobile and apps being the center of digital for consumers and businesses because companies can meet customers whenever and wherever the customers need to engage. Games, entertainment, social and other categories cater to the local market's preferences.

"M-commerce is an area the China market is particularly excelling at. Consumers are buying all sorts of goods and services through apps (ride hailing, prepared food delivery, groceries, etc.) and despite so much of the activity happening in apps like WeChat, Chinese consumers spend time in more apps (nearly 40 used per month) than other major markets (most between 31-35 apps used in a month). In the U.S., take the potential shown in China for consumers to spend in apps at an even greater rate and couple that with great brands and leaders (Amazon and Whole Foods is the example du jour to watch) and acceleration and growth are inevitable.

"As for in-app purchases, China game publishers are excellent at what they do, but the genres and titles that succeed there are often different from here. If we look at non-games, we monetize in other categories (e.g., video, music, dating) better in the U.S."

While we had Levitas we asked her the following questions about the report:

What do you attribute to higher time spent in apps?

Levitas, App Annie: It's a combination of more users coming to mobile (nearly 3 billion more from 2016 to end of 2021) and consumers in more mature markets using apps more. The latter is driven by companies from across industries investing in apps to deliver a more personalized, intimate and low friction experience. Early in the app market, it's largely about games, social, communications, then it's about entertainment and mobile-first experiences like ride hailing. But in recent years, we are seeing companies that pre-date mobile understand there is no channel like apps and verticals such as shopping, banking and fintech, travel and hospitality prioritize their app investments.

Users continue to download apps at a high rate, but what does the report say about retention?

Levitas, App Annie: The usage report report isn't focused on retention, but rather how long consumers spend in apps, the variety of apps they engage with regularly, etc. Retention is obviously a key metric and one our customers are very focused on and that our retention and usage data can support to maximize long term engagement of apps.

Anything about the findings that surprised you?

Levitas, App Annie: Three things in particular:

- First, when we looked at current data and saw that on average we spend more than 2 hours/day in phones globally (and 2 hours and 15 minutes in the U.S.) and realizing that this represents a MONTH out of each year. It's a stunning and powerful statistic.

Related to this is that on average we use 35 apps/month. Some countries closer to 30, some closer to 40. It's not all about the 2-3 popular social apps but a legitimate investment into conducting daily activities through mobile and apps. - Second, m-commerce is beginning to hit an inflection point and will grow nearly 5-fold by 2021. $6.1 trillion. As we create better, more frictionless experiences via apps, as we integrate payment systems and get more comfortable with them, as delivery and virtually anything-on-demand grows, it will fuel the spend on goods and services by both grabbing share from the physical world, the desktop and by carving share from other activities.

- Last one I will point out is related to the last one: Take the m-commerce, in-app advertising and app store spend and that works out to more than $1000/person/year in 2021.

Subscribe to Our Newsletter!

Latest in Mobile Marketing