This Too Shall PaaS? The Ins & Outs of Your Product as a Service.

Every product, really? Perhaps. Gartner predicted some time ago that everything that can be connected to the Internet, will be connected to the Internet:

- A chair can remind a person to get up and stretch or possibly even notify employers of employees' attendance or breaks

- A thermostat can learn a household's behaviors to adjust and save money (exists)

- A water bottle can track intake and connect to activity trackers (exists, see image)

- A child's watch could keep them on schedule with parent-controlled reminders (exists)

- A crib mattress can detect movement to alert parents digitally of potential issues (exists)

As more connected devices reach our lives (at home, at work, at play), they must be 'serviced' to demonstrate ongoing value, personalize experiences, downgrade/upgrade plans, reward use, offer cross-promotions or proactive service (e.g., offering a maintenance plan or scheduling service for a washing machine the company detects will malfunction soon based on quantity of completed cycles or learned signals) and other scenarios that will create significant operational complexity, which - it's safe to say - most companies aren't currently equipped to handle.

Where Are We?

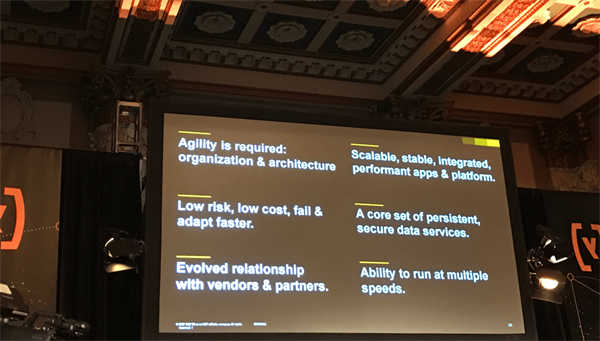

Despite professionals across industries recognizing the need for the digital transformation that those examples offer, as well as understanding how inefficiencies in their digital strategy directly impact their user experience, a new PointSource survey detects gaps in organizational and technical infrastructure that make it difficult for businesses to adequately address user needs across all digital channels.

The survey of 300 decision makers in marketing, IT and operations found that 84 percent of respondents' organizations have disparate legacy systems that impact the speed of development of new digital experiences and only 30 percent of respondents say departments within their organization always come together to problem solve.

How Do We Get 'There'?

As companies debate which technology to leverage - best of breed for specific problems, rip and replace of whole systems - to meet the expectations their customers already have (whether it's omnichannel functions like buy online, pick up in store or self-service functionality for buyers), startups are already moving past them in many areas (more on that in a bit).

It's a pivotal time in business when products are becoming connected and products are becoming subscriptions - both of which intersect at service and require supporting technology. To get to the product as a service (PaaS) model, however, companies must audit where they are.

When debuting its Revenue Cloud solution last week (an SaaS version of Hybris Billing that cherry picks billing and order management capabilities from the on-premise solution, which processes about $250 billion in users' customer orders annually), SAP Hybris, more specifically VP of Solution Strategy Fergus O'Reilly, provided the following scenario (paraphrased here) and used its product road map to do so:

A power tools manufacturer analyzes its customers to figure out how to deliver new value to them. By taking a look at customer behavior in Hybris Marketing, the company starts to segment people and see that its B2B customers are buying cordless power drills typically every other year in order to get the newest and greatest tool. Perhaps what the company should do is go to the 'iPhone model' where customers can buy a subscription for $30 a month and always get the latest version. 'Drilling' down further, the company can see where their most active customers are and launch a subscription-based service in that region.

To bill this subscription offer, the company logs into Revenue Cloud and sets pricing elements. The company decides that this offer should include usage-based fees since it's a 'connected' device, so every time the person uses the drill, they are charged 2 cents rather than a fixed price. This pricing model flows up to Commerce Cloud where it's now available to buy online, and a person is able to configure a power drill for their needs, request a personalized quote through the Engagement Center (live chat) and take any number of actions.

Can most organizations currently offer a product as a service and in a recurring subscription model? No, but it's not for lack of technology to get them there.

Today, retention doesn't have to solely exist on incentives though. Digitally connected products/services provide such an incredible data stream that, if agile enough, they can continue to reinvent themselves to add new value.

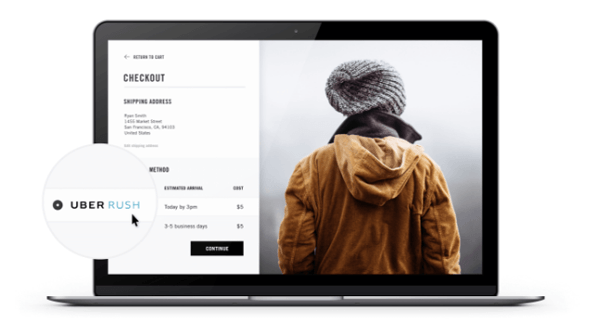

SAP Hybris executives shared the story of Uber wanting to see how much trunk capacity it had - finding it was more than the FedEx Fleet. Thus, on-demand delivery network UberRUSH was born and is live in Chicago, New York City areas and San Francisco.

Among the early adopters, is sunglasses manufacturer Maui Jim which partnered with SAP and UberRUSH to deliver and fulfill its orders quickly. This business model, as noted at the Digital Summit, is an "entitled version of what a consumer wants tomorrow." In other words, order something online and have it dropped off within an hour. That is the often over-stated "Uber effect."

Why Does This All Matter?

Raise your digital hand if you're tired of hearing about Uber in the same breath of every conversation about disruption, mobile functionality or user experience.

Since the industry has heard about 'Uber-fying' their business for years, some may have grown weary of talking about the company (perhaps even more so with ongoing reports of systematic sexism in its workplace) and may be looking for the next disruptive business model to discuss. The problem is that with their current technology in place (a customer relationship management solution here and a Web content management system over there), most enterprises are years away from the seamless data sharing and workflow needed to provide the experience Uber offers. As retailers and service providers consider unifying their technology, fumble through connecting data to leverage it in meaningful ways and debate about budgets and providers, consumers continue to open Uber and 'call' a ride instantly while being able to recall past orders, rate the people and process, leverage a seamless user interface, enter their destination electronically, refer friends for free rides, segment their orders by business and pleasure, use alternative payment methods, receive real-time transactional emails, and self-serve in a way not previously known - all while feeling empowered and important with a private driver versus feeling inadequate by being at the mercy of a driver who may or may not stop for them.

The people who use Uber are, well, people and they buy for their business, for themselves, for their family, for their home and for every other situation. This means that the self-serve, real-time, convenient nature of Uber is an expectation they will at some point bring to every business, if they haven't already. So whether a product will become a service because it's connected to the Internet or a product will become a service because it's being delivered through a subscription, we're all in the service game now - and disruptive experiences like those offered by Uber, or Maui Jim with its door-to-door service, or Stitch Fix with its ability for customers to easily start and stop service or its use of algorithms to deliver the best products, are all shaping business today.

O'Reilly of SAP Hybris encourages businesses to look at how their customers are behaving and interacting with them over time. If they are looking to go into the service model, there needs to be an ongoing interaction - whether that's the natural progression of the way products need to be replenished or it's built in like through connected devices. It is now the experience that is being sold, and the technology is needed to service that experience.

Who Is Coming for You?

Arguable, of course, but one of the best pieces of advice given at the Digital Summit was from Julie Collins of Alcon who said to spend a lot of time with startups in your industry, because they are the ones finding opportunity. It's true. Uber itself will continue to impact the transportation industry (going into automation and even affecting vehicle ownership), and there are more "Ubers" out there.GreenPal is a company Website Magazine has covered frequently. It is best described as "the Uber of lawn care." It provides next-day lawn care with the ability to schedule and pay online. It, like Uber, solves pain points: seeing reviews of lawn care professionals who often work independently, being able to pay them digitally versus leaving a check under the mat or mailing it to them (or worse, paying with cash) and submitting user-generated photos for bids.

Priv is an app for on-demand beauty and wellness professionals. Salons should be worried about it because it requires no vendor loyalty from the user, professionals will arrive at the location of the user's choice and customers can chat with the providers in-app.

Pending these two apps going to more markets and that the vendors they contract provide excellent service, they each have the ability to shake up their respective industry - and do so with more central data than their competitors that can be leveraged to retain customers.

When Will It All Happen?

It often takes a disruptor for others to pay attention and act. The disruptors - connected products, subscription services, self-service technology - are already here. The warning sirens have been activated. Knowing your customers (who they are, how they interact with you, what services they also buy, etc.) is the first step to understand how/if a business should change. Then, it's figuring out what technology can get you there.

+If all this makes your head spin, check out, "Balanced Web Operations."

Subscribe to Our Newsletter!

Latest in Marketing