The Majority of Product Searches Start on Amazon

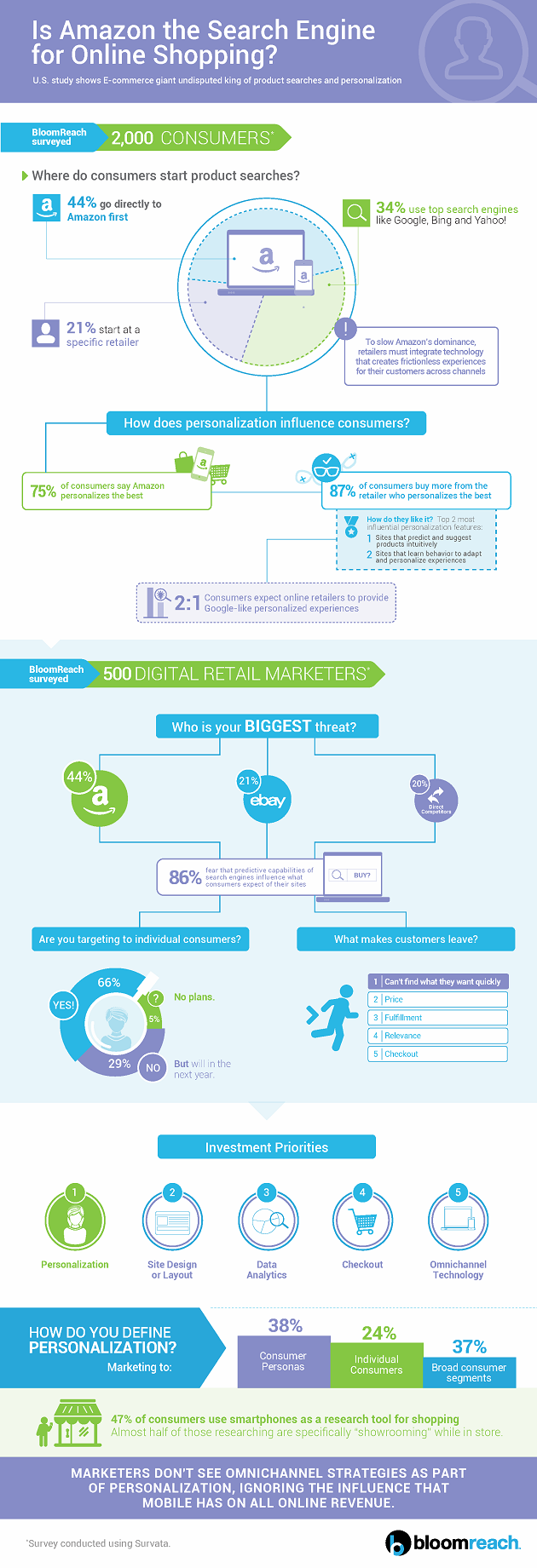

A whopping 44 percent of U.S. consumers go straight to Amazon when beginning to search for products online, bypassing search engines like Google, Bing and Yahoo.

This data, which comes from a recent Survata study commissioned by BloomReach, found that the majority of consumers begin their product searches on Amazon, followed by 34 percent of consumers who begin product searches on top search engines and 21 percent starting with a specific retailer.

In addition to shedding light on where consumers begin the digital shopping journey, the study also found that personalization is having a huge impact on purchasing decisions. The data found that 75 percent of consumers say Amazon personalizes the best, followed by Walmart at 9 percent and eBay at 8 percent. What's more, 87 percent of the respondents say they are more likely to buy from the retailer that best predicts their intent and suggests products intuitively.

"Amazon has turned a slow-bleed of search engines' and retailers' ecommerce importance into a gushing wound," said Joelle Kaufman, head of marketing and partnerships for BloomReach. "Search engines like Google have done their part by making product discovery and search intuitive, convenient and seamless; but if retailers want to slow Amazon's dominance, then they must integrate technology that creates frictionless experiences for their customers across channels. Amazon has a commanding lead, but retailer personalization and brand experiences can power a counterattack."

It is also important to note that BloomReach surveyed 500 digital retail marketers and found out that 44 percent cited Amazon as their biggest threat. Moreover, 86 percent said they fear that the personalization technology of top search engines like Google is influential on consumers' expectations for their own retail sites. Because of this, personalization ranked as the number one priority that marketers will invest in over the next 18 months.

The data also found that consumers and digital marketers agree that convenience and relevance are the top two values that personalization offers. However, the two groups disagree on what personalization feature provides the most value. For example, consumers value the onsite search box as the most-important feature, but marketers think that navigation elements like facets and filters provide the best value. That said, marketers are also split on how they define personalization, with 37 percent believing it's a tactic that is applied to individual consumers, while 24 percent say its applied to broad consumer segments or demographics.

Lastly, BloomReach's research revealed insights on smartphone shopping. According to the data, 47 percent of consumers shop on their smartphones to conduct research on products and pricing, and almost half of those researching on their smartphones are doing it while in-stores. Despite the increase in mobile traffic over the last year, 81 percent of consumers still say they prefer to make purchases on laptops and desktops. In fact, 64 percent of respondents cite the small screens of smartphones and difficulty of typing as negatively affecting their willingness to purchase on the devices. And even though previous BloomReach research reveals that consumers prefer to be recognized across channels, the company found that omnichannel technology ranked last in importance for digital marketers.

"People don't think 'Now I'm going to shop on my phone; now I'm going to shop on my laptop; now I'm back on my phone.' They just shop," said Kaufman. "But marketers often painfully approach omnichannel personalization in this way - siloing data and chalking every solution up to a responsive-design problem. Marketers are ignoring the 25x mobile-influence factor, inaccurately thinking that 'omnichannel' and 'personalization' are mutually exclusive."