SuiteWorld Speaks: Tips & Tech for Creating an Amazon-Like Experience

It's inventible that in a room full of retailers, the conversation will ultimately turn to Amazon and its market hold; predictably, this was the case in many sessions at NetSuite's annual conference held in San Jose this week.

Despite Amazon showing even more growth than in years past, some interesting technology and tips emerged at SuiteWorld on how to compete or collaborate with the "800-pound gorilla in the room," as many companies and executives called Amazon over the three-day event.

First, to understand just how big Amazon is, it should be noted that nearly half of U.S. households now have an Amazon Prime membership (which offers free - and often expedited - shipping among other subscriber benefits like early access to deals and streaming entertainment). What's more, the ecommerce juggernaut commanded 36 percent of online sales on Cyber Monday 2015 with the nearest competition (Best Buy) holding down just 5.5 percent market share on one of the busiest shopping days of the year according to Slice Intelligence. If that weren't enough, Andy Lloyd, GM of commerce products at NetSuite, says that Amazon is even one of Google's biggest fears as shoppers turn to the marketplace, rather than the search engine, to begin their shopping journey.

While it's insights like these that many retailers are all too familiar with (and often discouraged by), NetSuite CEO Zach Nelson repeats that his company's investments in their software suite allow anyone to deliver Amazon-like experiences - some would argue even better.

With the idea that Amazon is the driving force of change within an organization (as Lloyd puts it), let's explore how some retailers are pounding their chests against Amazon to the betterment of their bottom line, as discussed at SuiteWorld16.

STEP UP WITH SHIPPING

The single biggest reason for a shopper abandoning his or her shopping cart is shipping costs were too high, followed by shipping costs being communicated too late in the process. Retailers can certainly present shipping costs earlier in the shopping experience (e.g., with a banner or even a calculator), but lowering shipping costs is a much more complicated feat. Not only are shoppers demanding low-cost or free shipping options, but data from Dropoff also indicates 60 percent of consumers have decided not to purchase from a retailer due to slow delivery speed with the median expectation for retail delivery being two days (likely driven by Prime's popularity). How are retailers keeping up?

Alex Riffle, technical operations manager at True Brands, has implemented a multi-warehouse strategy to implement two-day shipping while Tony Drockton, CEO of Hammit, has decided not to ever offer free shipping at all in order to show a strong commitment to its wholesale channel.

Regardless of current strategies, NetSuite believes it can help retailers meet these demands by announcing it has built algorithms to automatically give end-users the best scenario for an order on how to get it the quickest and lower shipping costs - all defined by the customer at check out.

It's called Intelligent Order Management and it speaks to a couple industry trends besides Amazon's influence on shipping demands:

(1) Self-Service: Sixty-seven percent of customers prefer to help themselves over speaking to a representative. By giving shoppers the ability to determine their own shipping costs and speed, they are in control of their experience and in meeting their own expectations - quite possibly even reducing customer service inquiries if the order is fulfilled perfectly, which NetSuite believes it can help with too.

(2) Click & Carry: For some perspective on how popular "click-and-carry" transactions have become, nearly one-third of Sam's Club's total ecommerce sales in 2015 were bought online and picked up in store and those numbers can be seen in other retail establishments as well. This process requires incredible transparency between many systems to fulfill orders without hiccup. As most shoppers can attest, however, "buy online, pick up in store" often does not go very smoothly (e.g., post-purchase out-of-stock notifications, items not being available when promised, payment problems, return issues, no access to Web store info in-store).

Using NetSuite's inventory features, merchants can fulfill-from-anywhere and have complete access to inventory and shopper information (like abandoned carts and previously used addresses) in order to fulfill on the promises of the delivery options the end-user has chosen, which can even be mixed orders such as some items being picked up in-store, others being sent to a gift recipient, etc. These capabilities extend NetSuite's vision of bringing the website in-store, which was discussed the previous year.

BE EXCLUSIVE

Chris Goward, an optimization expert and founder of WiderFunnel, believes that understanding how your customers perceive a value proposition is the most important element in online marketing. When it comes to retail, savvy merchants are focused on making the perception of their brand, and its products, a key strategy for differentiating their offerings from what is available on Amazon.

Wingtip, a luxury men's store in San Francisco, just won't carry the brands that are available on Amazon, and even has long-term plans for launching a private label to compete against the marketplace. For Prospect Brands (the company that owns the iconic American brand Duck Head), customer loyalty (that's not determined by speed and price like on Amazon) is a key differentiator fueled by in-store interactions, the ability to complete ecommerce transactions (using NetSuite) in-store and its homegrown loyalty program, which it hopes to expand.

PROMOTE UGC

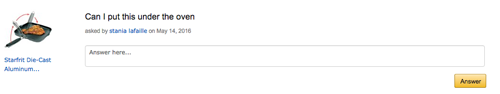

User-generated content (or UGC) is one of the most trusted forms of content and has been proven to increase conversion rates because customers are being influenced by their peers rather than brands. Amazon's product pages have robust review sections thanks to its email campaigns that ask for traditional reviews (stars and comments) as well as its Amazon Answers feature (pictured below) that works as a Q&A between a prospective customer, who has a question, and a verified buyer of that product who is willing to take the time to respond. Both reviews and Q&As are accessible features for any retail website. For instance, SportStop.com uses TurnTo for its customer Q&A sessions between interested buyers and confirmed purchasers.

Companies can take UGC a step further by curating content posted on social media that shows off their products in a complimentary way. Olapic is a popular provider that sources content from Twitter, Instagram, YouTube, emails and direct uploads so that retailers can approve the content, display it on product pages, make the images shoppable, get customer permission and track the success of each campaign. Olapic's strategic partnership with marketing automation provider Listrak brings these visuals to emails in order to make those shoppable as well.

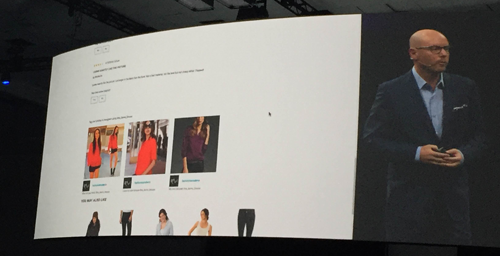

This week, NetSuite announced it will enter this arena with its Hashtag Gallery. The feature allows for similar functionality for those using its new Retail Apparel Edition, which shows a bold commitment from NetSuite to vertical-specific offerings. With Hashtag Gallery, retailers can manage and display galleries of related Instagram images from brand influencers and enthusiasts - all while keeping control over which images are published (example shown below with NetSuite Founder and CTO Evan Goldberg).

There was no talk about Hashtag Gallery working with NetSuite-owned Bronto (marketing automation), but one would have to imagine that UGC will end up in email at some point as this new suite of features for the apparel vertical also includes shoppable lookbooks, which could provide compelling reasons for shoppers to click through and buy.

RE-ENGAGE

More and more, consumers are leveraging their online shopping carts with retailers as a wish list of items they would like to purchase in the future. All retailers should consider adding wish-list capabilities (like Amazon) to their websites for a variety of reasons, but one is so that shopping cart abandonment data is more accurate. Even so, customers have left so many carts over the years that they've grown wise to the practice of retargeting - even waiting to buy until they get an incentive to act according to Bronto.

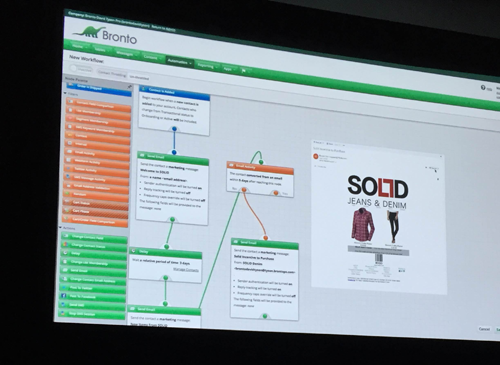

For this reason and others (like recapturing a lost sale), retailers will want to map out a strategy that includes re-engagement emails and the logistics of how those will be sent like frequency and which content to include - thinking about the entire customer experience from initial visit to post-purchase. Using Bronto, NetSuite customers can keep their shoppers engaged and coming back to the site with the abandoned cart app. They can establish what that engagement will look like (e.g., reminders, incentives) and create a workflow with triggers that target people who fit a category (looked 3-4 times but didn't buy anything, or bought seven days ago now it's time to send them a request for them to review the items).

Amazon retargets across the Web and it would be a smart choice for anyone selling on the 'Net to do the same (check out some retargeting best practices for doing so).

MAKE RECOMMENDATIONS

Fifty-two percent of shoppers are likely to take advantage of personalized product recommendations they get when visiting a retailer's website and a near equal (55 percent) amount of shoppers will take advantage of those recommendations sent via email.

One of the most recent apps to come out of NetSuite is its Predictor offering from Bronto, which allows brands to set rules to build out product recommendations, something Amazon is very good at and that shoppers welcome and even expect.

Building these recommendations is a three-step process where retailers (1) define settings that will define how the recommendation will operate (such as to not show the same shirt twice in different colors), (2) set priorities like higher priced items first and (3) review the message. An example recommendation could be sending top-rated products to the newest female subscribers.

BE AMAZING

There's no simple answer for how to work with or against the 800-pound gorilla known as Amazon, but not doing anything to separate your brand from competitors is not a strategy. Keeping up with customer demands, digital best practices and emerging technology - while keeping an eye on advances made by Amazon - will serve enterprises both large and small now and in the future.