Is Amazon Unbeatable? Or Did Retailers Give Up?

Heading into the holiday season, 51 percent of retailers view Amazon as a direct competitor.

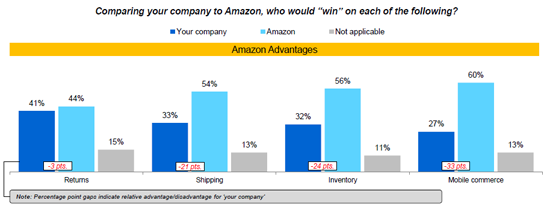

This according to eBay Enterprise's 2014 Holiday Retail Audit is because retailers believe Amazon has a competitive advantage in mobile commerce (60 percent), inventory (56 percent), shipping (54 percent) and returns (44 percent).

These findings likely do not come as a shock to Internet professionals, but what is surprising is that retailers seem to be throwing in the towel when it comes to all four of these areas. While smaller businesses (and even larger enterprises) will always struggle (and struggle mightily) with matching Amazon's inventory, the fight for mobile commerce, shipping and returns can be won(ish).

Going into the holiday shopping season, online retailers are least confident in their online/app experience and mobile commerce infrastructure, yet 2 in 3 online retailers do not cite mobile commerce as an area of investment, according to the eBay Enterprise study.

When it comes to delivery, retailers are simply missing the fact that they can compete.

"Retailers have an opportunity to win this battleground by increasing their delivery speed," said Tom Barone, head of omnichannel operations North America at eBay Enterprise. "Multichannel retailers can optimize their brick-and-mortar locations as distribution points to fulfill orders closest to customer location, reducing shipping times and cost through inventory and order management solutions. Retailers have implemented these omnichannel solutions in as little as 99 days, experiencing greater customer satisfaction, improved margins and increased sales."

Finally, retailers think they can't compete with Amazon's return policies, but Tom Caporaso, CEO of Clarus Marketing Group, recommends following Amazon's lead and charging restocking fees when customers return opened items to recover lost revenue. Alternatively, they could direct customers to programs such as Return Saver, which offers free shipping via FedEx Ground when shoppers return online purchases.