3 Surprising Online Shopper Preferences

When online conversion tactics like personalization, alternative delivery locations and live chat are part of everyday shoppers' lexicon, it's time for businesses to get serious about making it easier to purchase their goods and services.

Recently, comScore and UPS released the findings of its third annual UPS Pulse of the Online Shopper Study. Overwhelmingly, the results showed that customers have higher expectations when it comes to their online experience. For example, 53 percent of respondents want access to customer service within the checkout experience, 57 percent want their customer profiles pre-populated to save time and, even though most shoppers want their packages delivered to their homes, there is a growing trend for alternate delivery locations, such as a retailer's store (7 percent), workplace (5 percent), etc. Shoppers are also looking for the ability to re-route and reschedule deliveries.

Consumers are clearly getting savvier and, each year, UPS's report shows an evolution of how the the market is evolving, according to UPS Retail Director Bala Ganesh. Even though a lot of the evolution has been gradual, he found a few results surprising:

1. Desktop still important but mobile has shortcomings

Despite the increase in overall ecommerce transactions via mobile, desktop is still the dominant mode of making purchases online. Additionally, 41 percent of respondents said they prefer a retailer's full website versus a mobile website (34 percent) or mobile app (25 percent).

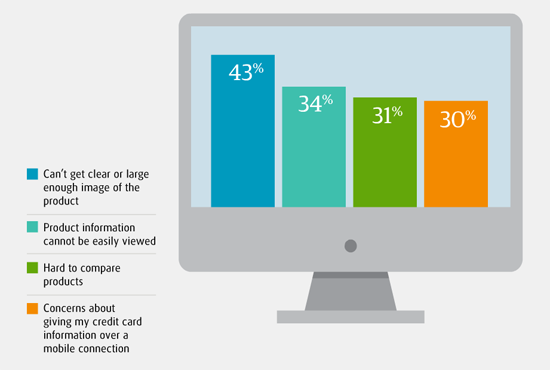

This is likely due to mobile's shortcomings, as 43 percent of respondents shop on their desktop computers rather than smartphones because they can't get clear or large enough images of the products. Comparatively, 34 percent of online consumers report not being able to easily view product information as a reason they shop on their desktops.

2. Even for frequent online shoppers, the role of the store for purchases and returns

Even though the survey population was skewed to online shoppers who make at least three purchases on average each quarter, according to Ganesh, people still prefer to buy and return things in store.

In fact, a store's return policy influences purchase intent. As 82 percent of online shoppers are likely to complete a sale if they can return in store OR ship back for free using a prepaid label. Sixty-seven percent are likely to complete a sale if returns aren't accepted in stores, but they can ship back for free using a prepaid label. Conversely, 51 percent of online shoppers are unlikely to complete a sale if a return is not accepted in store and they have to pay for return shipping.

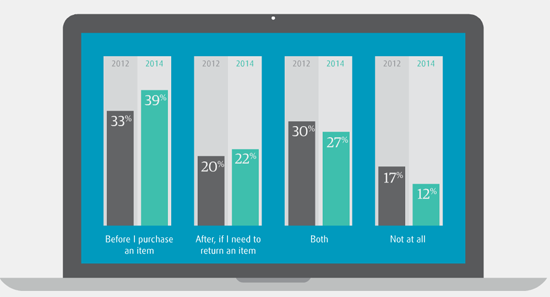

3. Returns are playing an increasing role in the buying experience

Since return policies influence conversion so much, 66 percent of respondents view a retailer's return policy before making a purchase. UPS also reports that the percentage of people who return items have gone up.

As merchants will see in UPS's report, consumer demands are higher than ever, but retailers should feel confident that so too is their willingness to spend this holiday season.

"We are seeing consumer confidence pick up, unemployment go down and seeing all the trends pointing toward an online shopping experience," said Ganesh. "Overall, we are looking at a pretty positive ecommerce season."

Bonus: Consumers Willing to Add, Wait for Free Shipping

Just like there is no such thing as a free lunch, there's no such thing as free shipping - someone is paying for it.

Still, according to UPS, free shipping continues to drive purchasing decisions. Fifty-eight percent of respondents indicated they have added items to their shopping carts to qualify for free shipping and 83 percent are willing to wait an additional two days for delivery if shipping is free.

How can smaller retailers compete? Ganesh of UPS says it's about how to maximize the customer experience given the different costs a merchant has.

What's more, he says free shipping is actually rare. Instead, retailers either compromise with free shipping as a special (as in buy $99 worth of merchandise and get free shipping), offer flat-rate shipping (e.g. whatever is purchased, it will cost $xx.xx to deliver) or just say shipping and taxes are extra. With free shipping with a special, merchants should test to determine what their optimal basket size is to be able to offer this special.

Retailers will need to determine their holiday shipping strategies soon, as not only are consumers more willing to buy when offered free shipping, but online shoppers are also demanding to see the expected day of arrival. Fifty-six percent of them want an exact date, not just a range of days that a package will be delivered. This is especially important during the holidays, as someone buying on Dec. 18 will want to know a package is delivered by Dec. 24, not 7-10 business days, and chancing that the recipient will get it after the holiday. When you get into the date range, according to Ganesh, it becomes difficult to convert. Ganesh continues saying that a date AND a time range is becoming a preference as well.